Capitalism is a remarkably powerful system for meeting our needs for survival and success. It’s why in America we now drive to our protests.

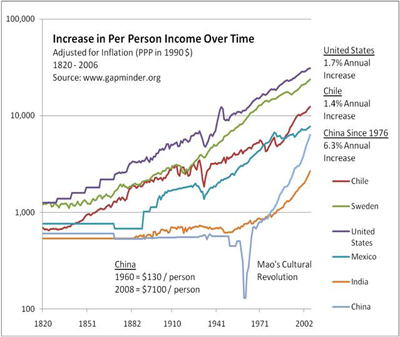

Capitalism’s greatest strength is its unparalleled capacity for economic expansion. Real per person income in first world countries has expanded exponentially and consistently for 200 years.

Capitalism’s greatest challenge is its addiction to economic expansion. Our entire financial system is predicated on the assumption that GDP will always keep increasing. Stock markets, debt and retirement funds all depend on this. So does our monetary supply. The financial crisis is a symptom of this challenge.

The problem is not our desire for money or our needs for survival and success. It’s our addiction to desire – also known as greed. And as any 12 step group knows, addiction creates denial. It literally causes us to go unconscious. Greed makes us stupid.

The financial bubble could not have happened without systemic denial and self-deception. At root, it was not caused by a failure in morality or regulation (though these played a part). It was caused by inadequate consciousness.

Bubbles are an automatic symptom of unconscious capitalism. While traumatic, they can be worked through using existing tools. However, the addiction at the root of this bubble cannot. Continuous exponential expansion is unsustainable, and we’re rapidly reaching its limits. The upcoming years are going to be increasingly defined by the collision of an “unstoppable force” (unconscious capitalism) meeting an “immovable object” (the environment’s limited resources).

This core problem cannot be solved through incremental change. It requires the creation of entirely new systems and ways of doing business: systems which are created from a higher level of awareness (i.e. consciousness) than the level at which the problems were created.

It requires us to develop systems of conscious business. It requires us to evolve.

1. Whetten, Brian. Capitalism 2.0…? http://ecoaching.corecoaching.org/?p=48

2. Eisenstein, Charles. Money and the Crisis of Civilization. http://www.realitysandwich.com/money_and_crisis_civilization

3. Whetten, Brian. The Real Root of the Financial Crisis. http://ecoaching.corecoaching.org/?p=15

About the author: Brian Whetten, Ph.D., M.A., had received a Ph.D., raised $20 million for two high tech startups, navigated multiple major life crises, become an internationally known academic and speaker, made and lost millions – and burnt out twice. He had gone from “being the one in high school that the chess team made fun of” to seemingly having it all. Yet he felt miserable. In the midst of an emotional and spiritual crisis, he began reaching out for help, and found his worldview shaken to its core. After suddenly “getting” the futility of trying to achieve his way to love, he turned his beat-down-the-walls-with-his-forehead determination inwards and immersed himself in six years of personal and spiritual development, with a series of incredible teachers, counselors, coaches and programs.